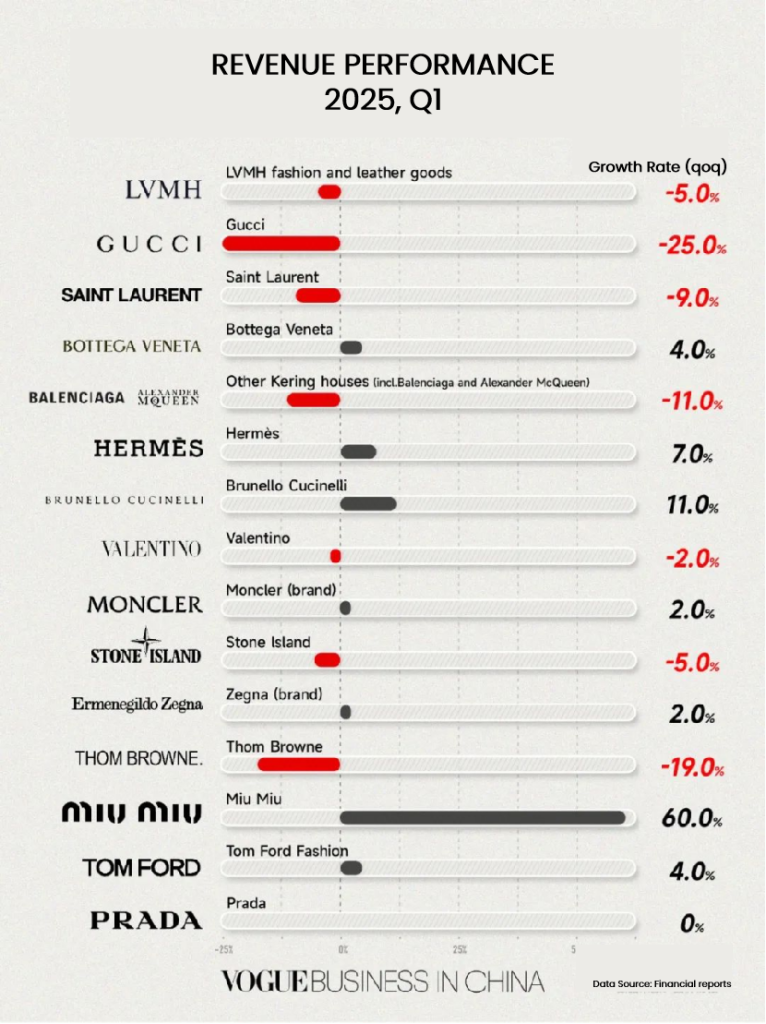

In recent years, China’s luxury market has faced significant challenges. Traditional luxury consumption has cooled, with declining performance, frequent store closures, and layoffs. While China is still considered a long-term growth engine, consumer confidence has yet to fully rebound in the short term, and high-net-worth individuals are becoming increasingly cautious with their purchases. Brands must abandon the illusion of “automatic growth” and confront the core issue of “declining traffic.”

Francesca Bellettini, Deputy CEO of Kering Group, noted during the company’s earnings expressed that their challenge is to improve conversion without diluting brand equity or resorting to heavy discounting.

To this end, some brands have turned to high-frequency entry-level products such as fragrances, beauty items, and scarves to attract foot traffic and drive conversion for higher-priced, less frequently purchased items, thereby stabilizing their market foundation.

E-Commerce Observation: rednote Emerges as a Second Battleground for Luxury

Traditional shelf-based e-commerce lacks the communicative depth needed to convey luxury brand value. However, rednote has emerged as a key breakthrough platform due to the strong overlap between its user base and the target demographic for luxury goods.

According to the 2024 QianGua rednote User Behavior Report:

- 17%+ are urban Gen Z (digital natives living in top-tier cities, fond of online shopping)

- 9%+ are urban white-collar workers (primarily born in the ’90s, convenience-driven)

- 7%+ are youth from lower-tier cities (with more disposable income and a trend-following mindset)

- 6% are refined mothers and urban middle-class

- 3% are silver-haired urbanites and middle-aged individuals from smaller towns

As of 2024, rednote boasts 300 million monthly active users, with 70% female ratio. Users born after 1995 and 2000 account for 85%, and users from first- and second-tier cities make up 50%. This young, high-spending user base provides an ideal foundation for luxury brands to precisely reach their target audience.

Rednote further strengthens this with a segmentation model based on the relationships between people, needs, and products, identifying six core lifestyle personas relevant to luxury:

- Luxury Lifestyle Enthusiasts: Mostly 35+, see luxury as a status symbol that reflects their social standing, prioritizing exclusivity and highly personalized experiences.

- Milestone Rewarders: Typically in early or rising career stages, associate luxury with meaningful milestones and treat themselves to premium products on special occasions.

- Trendsetters in Luxury: Primarily under 35, see luxury as a form of self-expression and use high-fashion to showcase unique aesthetics and personality.

- Quiet Luxury Connoisseurs: Also under 35, but favor understated elegance, viewing luxury as a refined expression of everyday life and personal taste.

- Luxury Beginner: Mainly under 25, view iconic luxury items as social “passports” that help them integrate into new circles.

- Circle Expanding Activists: Ambitious individuals under 25, leveraging luxury goods as tools to build networks and enhance professional presence.

Miu Miu’s Winning Formula: Lifestyle Marketing on Rednote Drives Breakout Growth

Miu Miu has achieved standout growth through strategic use of social media. After posting a remarkable 93.2% year-over-year sales increase in 2024, the brand continued to lead the luxury sector with 60% growth in Q1 2025, ranking second on Lyst’s Global “Hottest Brands” Index. The brand’s aesthetic blends a variety of styles—Y2K retro, quiet luxury, balletcore, and “rich girl” elegance—into a distinctive visual identity.

Its success is deeply tied to marketing strategies on platforms like rednote.

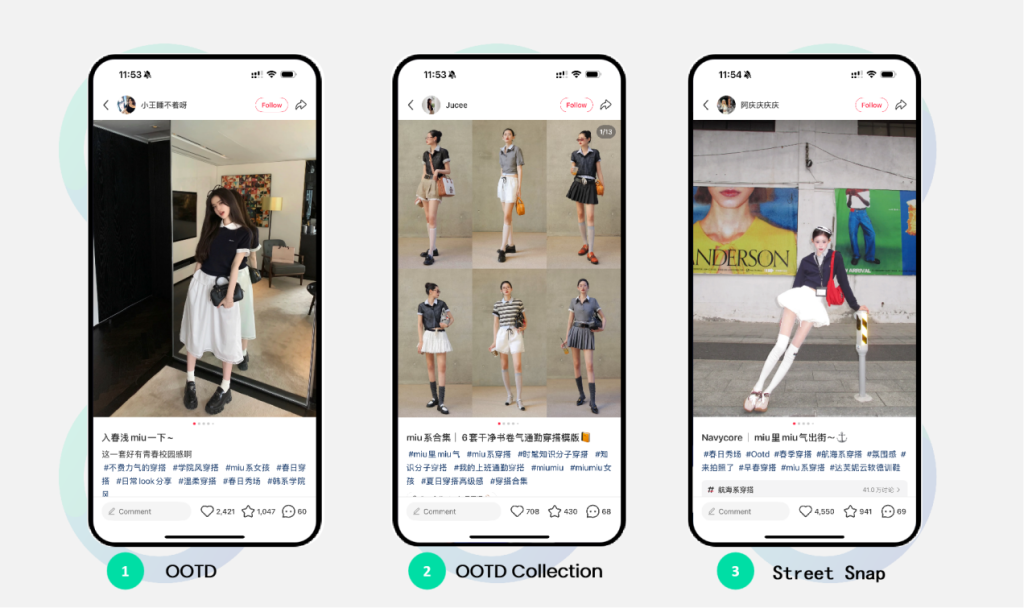

01 Viral Products: Rebellious Aesthetics Capturing Gen Z

Miu Miu partnered with former Balenciaga stylist Lotta Volkova to launch daring pieces like “underwear as outerwear,” low-rise mini skirts, and ballet flats. These counter-mainstream designs resonate with Gen Z’s desire for individuality and “social currency.”

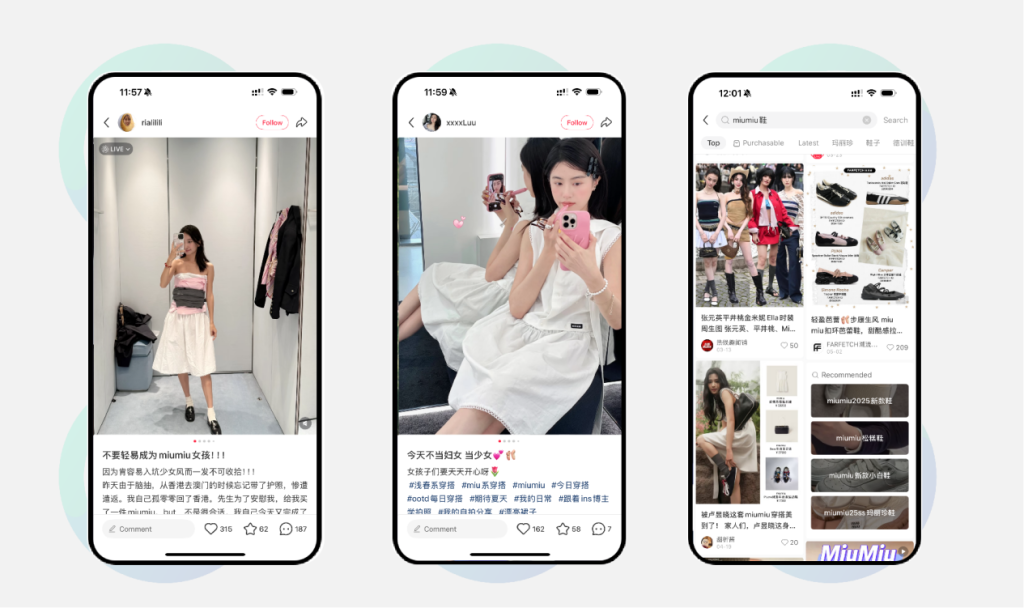

From the viral midriff-baring looks in 2022 to the vintage college and ballet fusion styles in 2024, Miu Miu continues to capture attention. The brand also uses a centralized data system to monitor social buzz and identify breakout products within 72 hours. Each season, 1–2 “experimental pieces” (e.g., crystal socks) are released, with production volume adjusted based on social media response.

02 Expanding Visibility: Celebrity Endorsements & Localized Events

To appeal to Chinese consumers, Miu Miu signed Gen Z actress Liu Haocun as an ambassador. Her influence helped ignite a trend around the “Miu Girl” look across Instagram and Douyin. The brand also curated offline experiences aligned with rednote’s “check-in” culture—such as a Lunar New Year vinyl signing with artist Liu Boxin, flower boat cruises in Guangzhou’s Liwan Lake, and ice skating events at Beijing’s Shichahai—bridging online and offline engagement.

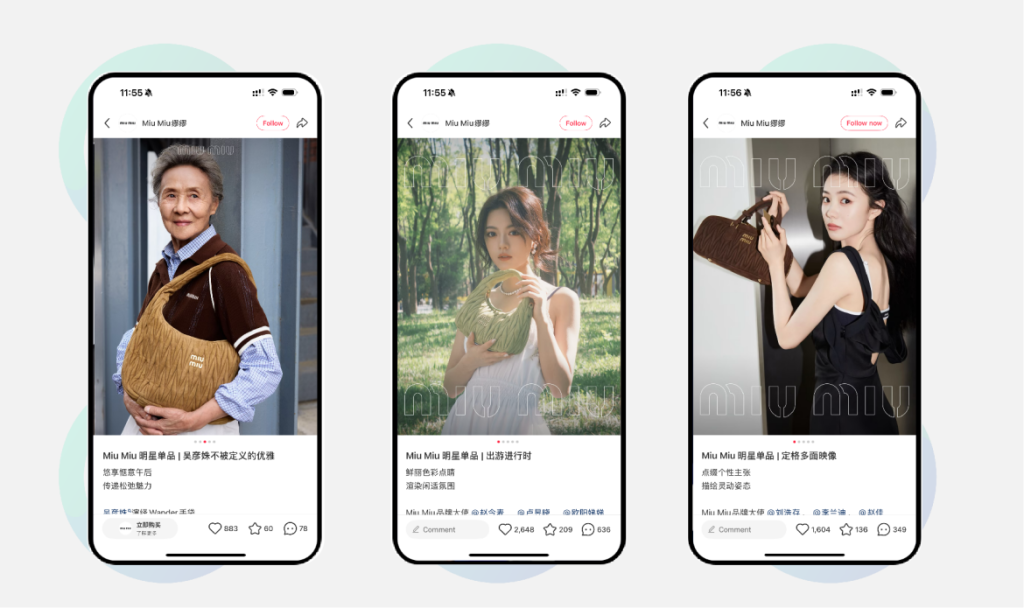

03 All-Ages Campaigns: Breaking Age and Gender Barriers

Miu Miu challenged traditional norms by featuring 70-year-old retired doctor Qin Huilan and 85-year-old actress Wu Yanshu on the runway. The brand also produced 29 short films in its “Women’s Stories” series and hosts Miu Miu Musings salons, addressing social topics and engaging high-net-worth, mature audiences.

04 Social Media Buzz Building

Miu Miu actively shares fashion shoots and celebrity street styles on rednote, promoting hashtags like #miumiugirls to encourage user-generated content (UGC). According to McKinsey, 70% of luxury shoppers consult KOL content before visiting physical stores. Miu Miu’s “dual-channel synergy” strategy successfully converts online engagement into offline purchases.

As traditional growth models lose momentum, rednote—with its highly aligned user base and content influence—has become a core battleground for luxury brands. Miu Miu’s case demonstrates that by capturing youth culture, crafting age-inclusive narratives, and executing deep social media engagement, brands can achieve remarkable growth in the Chinese market.

Looking ahead, luxury brands must deepen their cultural resonance—connecting product value with identity and emotional needs—to lead the next wave of social-first marketing.

Source of featured image: Photo by Yves Cedric Schulze on Unsplash